Australian Climate Commitments 2035: Policy and Market Implications

Australia has now set out its 2035 climate target and long-awaited net zero plan, a significant step that will require strong policy frameworks and market alignment to translate ambition into delivery.

Australia’s 2035 target

Australia has pledged to reduce its emissions by 62-70% in 2035 compared to 2005 levels. This target range was recommended by the Climate Change Authority in its advice to the Government, which also stated its belief that achieving even the lower end of the target range ‘won’t be easy’.

ASFI welcomed this target but noted that the target needed to be matched by credible policy frameworks to turn ambition into delivery.

Net Zero plan

The Government also announced its net zero plan that sets out its preferred pathway towards net zero. It emphasises scaling up of renewable electricity supply; increasing energy efficiency and electrification; expanding use of other clean fuels; commercialising new technologies; and increasing carbon sequestration.

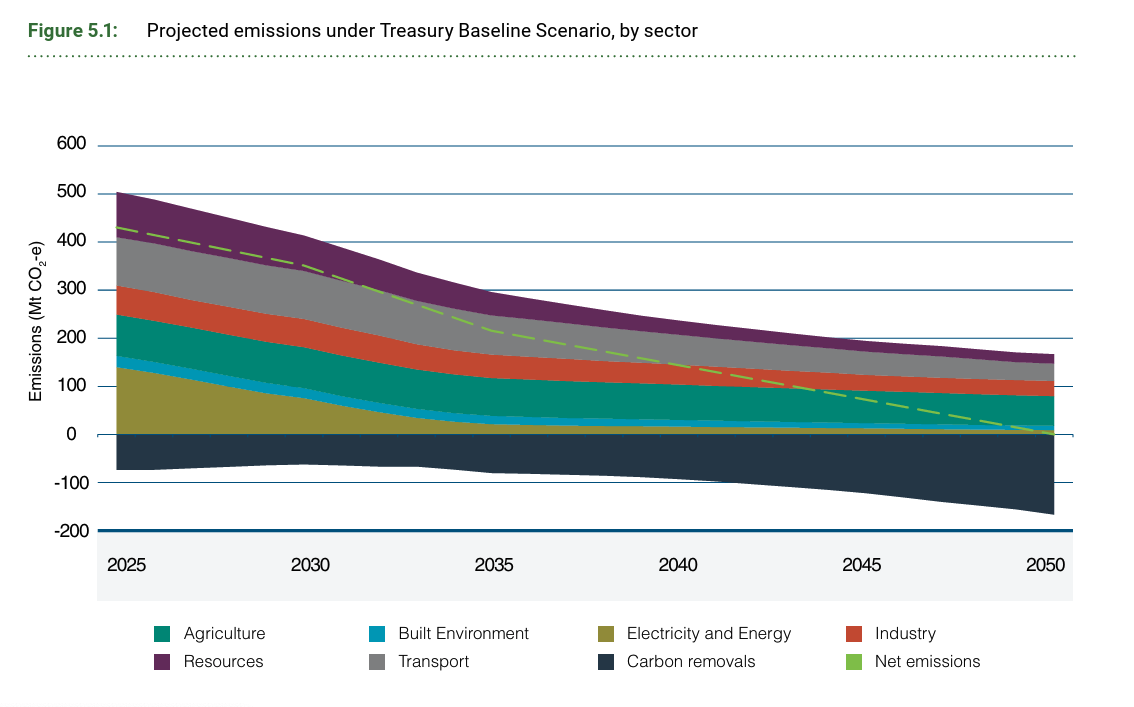

Under the plan, most emissions reduction comes from the electricity sector up to 2035, and through an increasingly large amount of carbon removals to 2050 through reforestation and other land sector activities.

More modest reductions are expected in resources and industry, with minimal reduction achieved in the agricultural sector. ASFI has previously noted that reliance on land sector offsets does not place Australian industry on a trajectory towards decarbonisation and prospering in a low-emissions economy.

Image source: Australian Government, Net Zero Plan (p44)

Sector plans and Policies

The net zero plan is further split into six sector plans that point to the Government’s approach in the electricity and energy, agriculture and land, built environment, industry, resources, and transport sectors. These sector plans take the general approaches from the net zero plan and apply them to the challenges in each sector.

Overall, the plans note the application of current policy frameworks to each sector but do not give strong indications of future policy frameworks to achieve emissions reductions in each sector.

For example, the sector plans rely heavily on electrification and reduction in emissions from grid electricity to achieve a significant part of the 2035 target. Consequently, the plans highlight the importance of improving energy performance and accelerating the rollout of the renewable electricity.

However, only existing policy levers, such as the Clean Energy Finance Corporation and the Capacity Investment Scheme, and improvements to building rating schemes and equipment energy efficiency standards are noted. While these policy levers are having impact, it is clear further policies will be needed to achieve even the lower end of the target.

Enhancements to existing policy frameworks will form important parts of achieving emissions targets. In particular, the Safeguard Mechanism (which imposes an obligation for large emitters to reduce their emissions) will be reviewed in 2026-27, providing an opportunity for increasing the scope and ambition of this policy. Expanding the coverage and stringency of the Safeguard could help extend the application of carbon pricing into the economy, sending stronger signals to encourage decarbonisation.

Supporting announcements

The Government made additional announcements to support the release of the target, including spending $1.1 billion on low carbon fuels, providing an additional $2 billion in equity to the Clean Energy Finance Corporation, and quarantining $5 billion of the National Reconstruction Fund’s capital for a new ‘Net Zero fund’ to support scale-up of low emissions technologies.

DCCEEW briefing and ASFI engagement

Following the announcement, ASFI CEO Kristy Graham attended a roundtable with Minister Chris Bowen and Climate Change Authority Chair Matt Kean, and reminded government that the finance sector will need clear policy frameworks to ensure investment can be driven towards achieving the emissions reduction targets.

Kristy outlined how durable policies, including at the sectoral level, are critical for all of the finance sector to be involved. She also noted the importance of aligning finance sector policy to the task, including looking at corporate, financial and prudential regulation to remove barriers to unlock the private sector investment necessary.

ASFI then hosted a briefing on the targets and sector plans, joined by senior public servants Kath Rowley from DCCEEW and Alex Heath from Treasury, you can watch the webinar recording below.

National Climate Risk Assessment and Adaptation Plan

Preceding the announcement of Australia’s 2035 target, the first National Climate Risk Assessment was released by the Australian Climate Service. It predicts increased hazards from coastal flooding, increased marine heatwaves, reduced water availability, reduced crop yields and increased disease risks from insect-transmitted infections. The report assesses risks across eight systems, including:

primary industries

the natural environment

infrastructure and the built environment

health and social support

the economy

national security

communities and

Aboriginal and Torres Strait Islander peoples.

The assessment was complemented by the release of the National Adaptation Plan, which sets out the first-pass response of the federal government to the climate risk assessment. Unlike previous plans, the adaptation plan does not extensively involve state and territory governments, instead focusing on action and leadership that the Commonwealth can take. The report specifically highlights the importance of finance and investment in adaptation, and suggests actions to attract private investment into priority adaptation projects and ensuring the Clean Energy Finance Corporation better considers physical risk and adaption in new investments.

ASFI was also pleased to see that the Plan flags considering expanding the Australian Sustainable Finance Taxonomy towards adaptation and resilience, and we will work to see this vision come to reality as soon as possible.

However, the Adaptation plan commits to few concrete actions. Private sector investment in adaptation and resilience will rely on clear signals and frameworks to flow, and to ensure investments optimise adaptive capacity.

Development of a clear framework to combine private and public sector finance towards adaptation is urgently needed, and the Plan could work to bring the finance sector including insurance, investment and banking, together with federal and state governments to guide co-investment in adaptation and resilience.