2024 Strategy and

Business Plan

ASFI’s Value Proposition

ASFI operates across the whole financial system to address systemic challenges across climate, environment and social aspects of the sustainable finance agenda. We have close and productive working relationships with regulators and government to support or drive development of policy and regulation in this area, and act as a bridge between the finance sector and government.

We are highly collaborative, recognising, amplifying and supporting progress on Roadmap implementation by other organisations and partner with other industry organisations, government, our members, international peers and think tanks and research institutions are a strong focus for ASFI. Our membership base comprises of progressive organisations across the financial sector who are driving the growth and credibility of sustainable finance in Australia.

ASFI’s 2024 Work Program

Following consultation with ASFI members, Board and partner discussions and analysis on how ASFI should focus its resources to achieve its mission, ASFI will focus on the following priority areas in 2024. These areas represent a continuation of work from 2023, and this continuation will enable us to deliver on the objectives of these programs of work.

Our Structure

The work that we’re doing means working with many different organisations to drive change. Our formal structures reflect the whole of sector, inclusive approach that is a core strength of ASFI, and these formal structures are complemented by many more informal partnerships and networks.

ASFI has been established as a company limited by guarantee and is a registered charity, regulated by the ACNC.

-

The ASFI Board provides oversight of ASFI, with six Directors elected from the ASFI membership (2 members each from asset owners/asset managers, banks and insurers). There are two additional Board seats that can be filled from outside those categories, including by non-members. As an important part of ASFI governance, the Board provides high level guidance and oversight for ASFI. Current Board members are Kristian Fok (Chair), Michelle McPherson, Katharine Tapley, Vivienne Bower, Jeff Brunton, Connie Sokaris, Fiona Reynolds and Robynne Quiggin.

-

The Advisory Committee provides advice to the ASFI Board and management and ensures close coordination of ASFI activities with other organisations working in sustainable finance. Industry organisations, universities, think tanks, financial regulators and government are represented on the Advisory Committee. Current members include Anna Skarbek (ClimateWorks, Chair of Committee), Estelle Parker (RIAA, Deputy Chair of the Committee), Robynne Quiggin (UTS), Kar Mei Tang (PRI), Kylie Macfarlane (ICA), Kate Griffiths (ACSI), Rebecca Mikula-Wright (IGCC), Emma Penzo (ABA), Katherine Palmer (NSW Treasury) and observers Jeremy Lawson (RBA), Sean Carmody (APRA), Claire LaBouchardiere (ASIC), Alex Heath (Commonwealth Treasury).

-

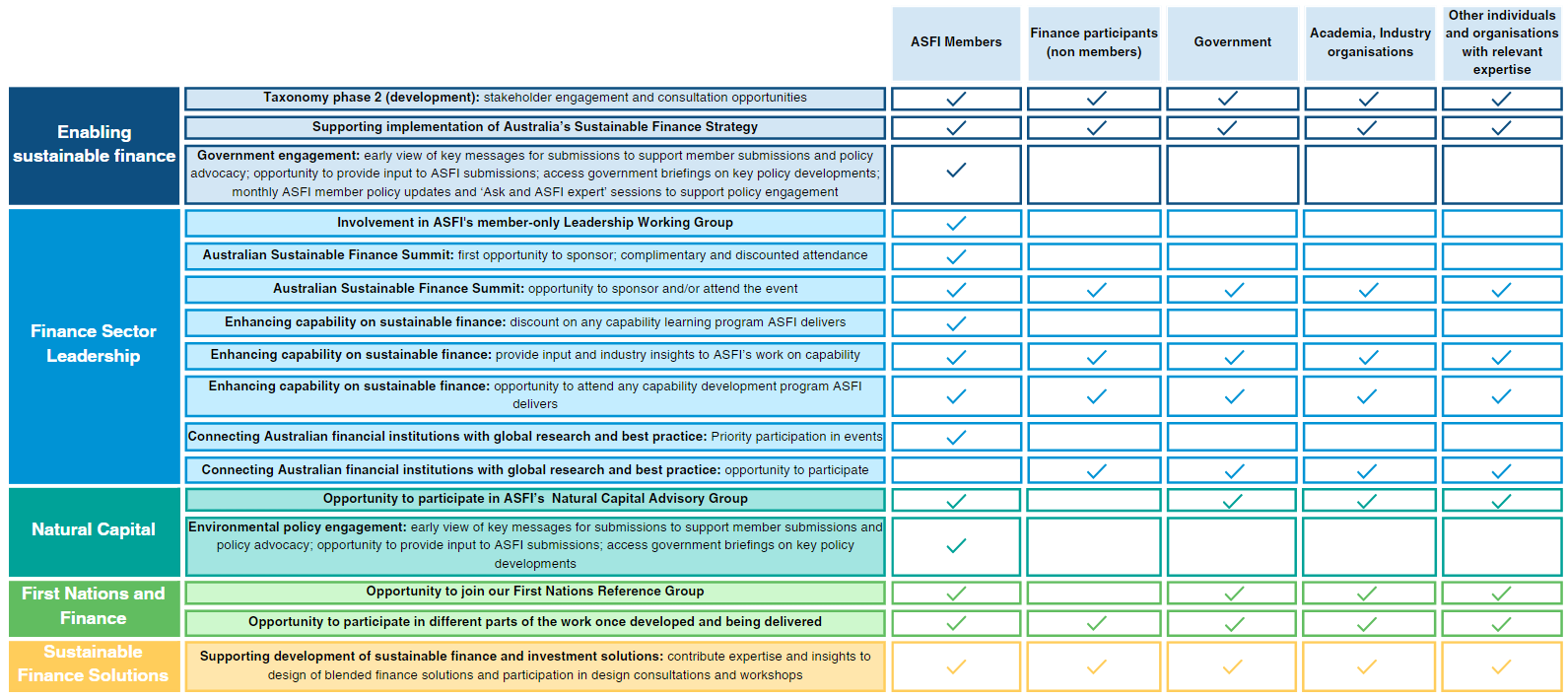

ASFI members are financial services companies and institutions support ASFI’s vision and mission. In addition to annual membership fees, they actively contribute to ASFI’s projects and work. Full members can nominate someone for the Board and vote at the ASFI AGM. Members also have priority access to ASFI project working groups, collaboration clusters, invitations to member-only government engagement and other events, and discounted tickets to the Australian Sustainable Finance Summit. ASFI members are listed here.

-

Groups of people from across the finance sector, brought together to make progress on discrete issues that can accelerate Roadmap implementation. The cluster would be time-bound in nature and projects may spin off from the cluster to be implemented by ASFI or other organisations. ASFI will facilitate, convene and drive the work of these clusters. Collaboration clusters are an evolution of the Roadmap recommendations to establish Forums to bring different parts of the Australian Financial System together to make progress on particular issues or areas of work in line with the Roadmap.

-

These are organisations whose work is taking forward implementation of some Roadmap recommendations. ASFI works closely with these organisations to ensure strong coordination across the financial system, and these organisations support ASFI to identify gaps in Roadmap implementation that ASFI may fill. Many of these organisations are represented on ASFI’s Advisory Committee, a mechanism, amongst others, for institutionalising strong collaboration between implementation partners.

-

ASFI will identify priority projects that are critical to implementation of the Roadmap that it will drive. The governance and delivery structure of ASFI projects will differ depending on their scale and complexity, and ASFI’s role in them. Project Steering Groups, Working Groups and Advisory Groups may be established for some projects. Projects are expected to operate for at least 12 months.

How we work with others

Partnerships and collaboration are critical for successful implementation of the Roadmap. The nature of the systemic change we are trying to achieve, and the type of organisation that ASFI is, means that working in partnership is critical to our success. We work through formal and informal partnerships with a range of organisations.

Different types of partners we work with include:

-

Organisations or individuals working closely with ASFI, under some kind of contractual arrangement, to deliver ASFI priority projects.

-

Organisations who contribute core or project funding to ASFI and may also play a role in the ASFI Advisory Committee or Project governance.

-

Organisations who are working to deliver Roadmap recommendations. ASFI works closely with these organisations to ensure strong coordination across the financial system, and these organisations support ASFI to identify gaps in Roadmap implementation that ASFI may fill. As part of ASFI’s annual Progress Tracker, these organisations share information with ASFI on their progress and contribution to Roadmap implementation. During 2024 ASFI will work with implementation partners to develop an MOU that institutionalises the collaboration between these organisations.

-

These are organisations whose work is taking forward implementation of some Roadmap recommendations. ASFI works closely with these organisations to ensure strong coordination across the financial system, and these organisations support ASFI to identify gaps in Roadmap implementation that ASFI may fill. Many of these organisations are represented on ASFI’s Advisory Committee, a mechanism, amongst others, for institutionalising strong collaboration between implementation partners.

-

Individuals from organisations whose work intersects with ASFI’s and whose mission is broadly aligned to ASFI’s. They provide advice, draw connections and identify opportunities for the organisation and others to partner with ASFI in different ways.

-

Organisations who ASFI works with on a one-off basis for mutual benefit.

-

Individuals who contribute to specific ASFI projects or workstreams. Usually formed on the basis of an EOI process or nominations from organisations with relevant expertise, knowledge and ability to contribute.

While recognising the value of partnerships, ASFI does not have the resources to partner with every organisation. We will prioritise partnerships based on the following principles:

Alignment of values and unique value add: The proposed activity and partner are aligned with Roadmap and ASFI objectives and there is an alignment in values between ASFI and the partner. Organisation is reputable and partnership adds unique value to both organisations.

Leveraging the partnership and collective benefit: Partnering with the organisation provides ASFI with access to valuable knowledge and expertise, stakeholders and relationships, funding or credibility that can be leveraged for broader ASFI objectives and more can be achieved for both ASFI and the other organisation than without it.

Conflicts of interest: ASFI does not create any significant real or perceived conflicts of interest as a result of the partnership, and where these may exist they are able to be managed transparently and effectively.

Reducing complexity for ASFI members: Partnering will enhance coordination between ASFI and other organisations, simplifying the sustainable finance landscape for ASFI members and the system more broadly.

Resourcing: ASFI has sufficient resources to play its proposed role in the partnership and ensure the partnership is a success.

ASFI won’t work with organisations who

Expect undue influence over content or delivery of our work as a condition of partnership.

Are not aligned with our vision and mission.

May not uphold the high professional and ethical standards of ASFI as outlined in our Board Charter and Constitution.

As well as partners, who we work closely with, there are many other stakeholders with an interest in ASFI’s work. ASFI may draw on the skills and expertise of this broader network for some of its projects and the ASFI network can stay up to date on our work and opportunities to participate through our regular newsletter and on LinkedIn. ASFI runs a range of events for our network including the annual Australian Sustainable Finance Summit and public webinars and events on sustainable finance topics.

Working with ASFI in 2024