How Australia’s Climate Policy Architecture is Enabling Private Capital for Net Zero

Australia’s climate policy framework has evolved rapidly over the past four years, and while it hasn’t evolved through a single plan, it’s starting to form a system that gives financial institutions the clarity and confidence to back the transition.

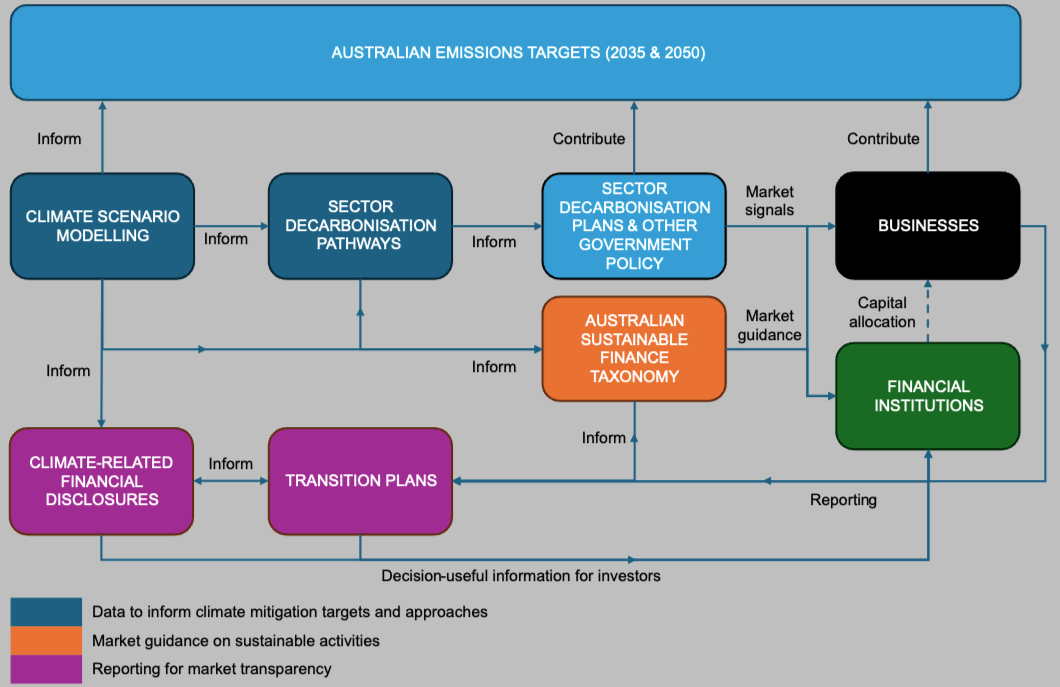

Our latest paper, How elements of Australia’s climate architecture combine to enable private capital flows for climate mitigation, maps how the key components fit together, from sector pathways and disclosure rules to the Australian Sustainable Finance Taxonomy.

Figure 1: Relationship of key initiatives to support national emissions targets

It highlights how:

Credible climate modelling and sector pathways now guide investment planning.

Government sector decarbonisation plans help signal which technologies and industries are supported.

The Australian Sustainable Finance Taxonomy turns those pathways into clear investment definitions.

New climate-related disclosure and transition planning rules build the transparency investors need.

Together, these elements form the backbone of Australia’s emerging sustainable finance system, helping align finance and policy to accelerate Australia’s orderly transition to net zero.